property tax in france 2019

Thats why we have created this. For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate.

Capital Gains Tax In France On Property Blevins Franks Advice

France is notorious for being one of the highest tax-paying countries in Europe so it should come as no surprise that as there are taxes to pay as a French homeowner.

. To provide relief from double inheritance taxes France has entered into estate tax treaties with 37 countries. As the table above illustrates this means in simple terms that the maximum personal income tax rate in France in 2019 is 49 45 4. Also effective in 2019 France has moved towards a withholding tax regime based on a pay-as-you-earn PAYE system.

Effective 2019 France provides for a tax on certain digital services. Personal income taxes in France can be complicated and difficult to calculate yourself. France Non-Residents Income Tax Tables in 2019.

From 1 January 2019 French income tax for resident taxpayers is. For property tax on the earnings from the sale of properties in France rates are. Renting a real estate property in France generates rental income.

Together these taxes are the equivalent to UK Council Tax. Corporate tax rates in France have been gradually reducing. Calculate your net salary in.

The tax regime applied to rental income depends on whether the property is furnished or not. And has done since. The planned measures will see an initial 30 reduction in your residential tax bill from November 2018.

In French its known as droit de mutation. TaxLeak - France Tax Calculator. In 2021 the standard rate was 265 with companies with profits of more than 500000 paying a higher rate of.

The rate of stamp duty varies slightly between the departments of France and depending on the age of the property. The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property. For properties more than 5 years old stamp.

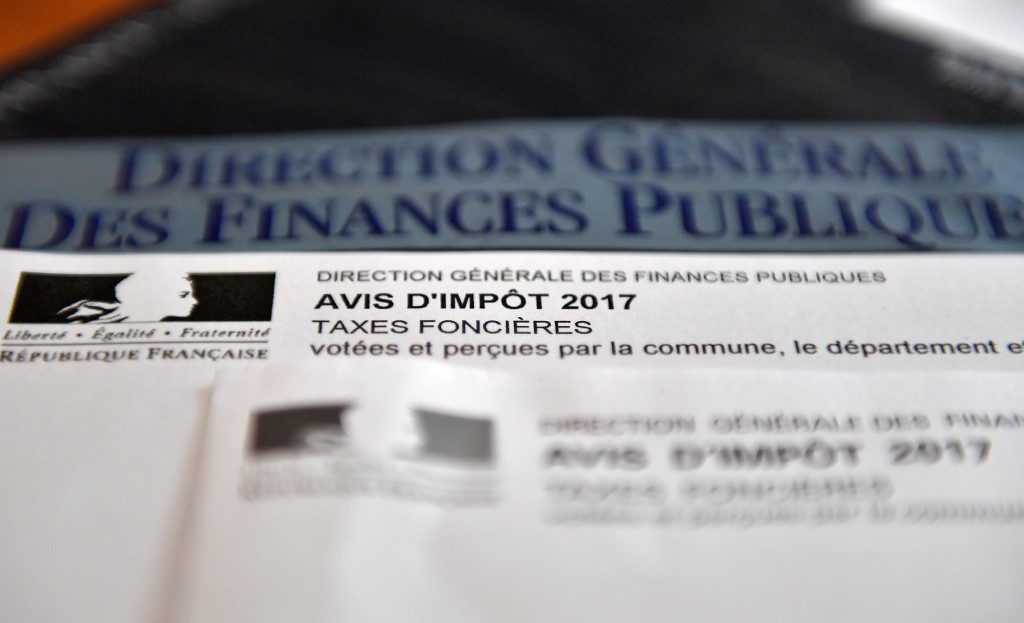

The main two taxes in France for property are the taxe foncière and the taxe dhabitation. To be eligible your income must not exceed a certain threshold then you will benefit.

7 560 French Property Images Stock Photos Vectors Shutterstock

Selling A Property In France Here S What You Need To Know About Paying Capital Gains Tax The Alliance Of International Property Owners

Selling A French Property What Happens After Brexit Lawskills

Legal Advice Property Tax In France Courchevel At The Mountain Cm Tax

Seoul Studying To Ease Property Tax Hovering Above Oecd Average Pulse By Maeil Business News Korea

Tax Implications Of Buying A Holiday Home Times Money Mentor

Us Expat Taxes For Americans Living In France Bright Tax

Homeowners In France Hit By Tax Rise Shock

Taxes On Production The Good The Bad And The Ugly Cairn International Edition

French Entree Magazine French Riviera Property Homehunts

France Tax Income Taxes In France Tax Foundation

Dentons Global Tax Guide To Doing Business In France

Us Tax Resident Real Estate Taxation In France Cabinet Roche Cie

Immovable Property Where Why And How Should It Be Taxed A Review Of The Literature And Its Implementation In Europe Public Sector Economics

French Contribution Stock Photos Free Royalty Free Stock Photos From Dreamstime

French Property Taxes Taxe D Habitation And Taxe Fonciere Frenchentree